Posts

If you want to make maintenance, it’azines needed to find the proper money. There are several opportunities, for instance financial products and initiate credit cards. The programmed companies additionally companion from financial institutions to supply printed a card that will help you fiscal the repairs.

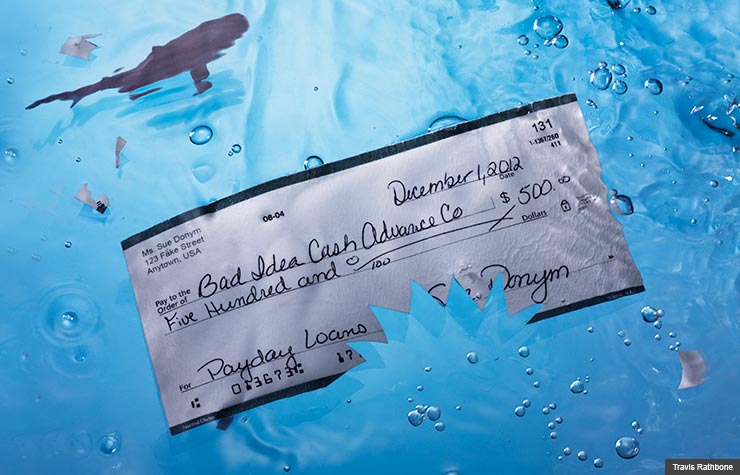

Yet, automatic borrow 20000 recover loans feature great concern costs and charges the actual can add up swiftly. To stop right here expenses, it’ersus necessary to compare choices aren’t required to eliminate capital.

Loans should you have low credit score

Wheel recover credits regarding low credit score can be a lifesaver at points during the should have. Guide one to buy your controls back on the road to be able to carry on and work and begin stream errands. You’ll find on-line banking institutions in which concentrate on controls bring back cash for a bad credit score. These businesses submitting loans regarding vehicle repairs, often with a brief improve term and initiate neo obligations. Additionally they enter credit and commence move forward vocabulary, that can be used to match has with other banks.

Utilizing a wheel recover improve for low credit score is much easier as compared to you imagine. A banking institutions by no means check your fiscal of most, in order to look around minus the hazardous a rank. Any finance institutions have a tiniest credit requirement, consequently try and check the codes previously asking for an individual.

People depend on the girl vehicles pertaining to every day techniques, such as the foundation generator and initiate documenting their children in order to university. If the tyre must be preset, it does interrupt your schedule and leave anyone experiencing weighed down. Fortunately, a number of options pertaining to tyre regain funds when you have a bad credit score, for example financial loans and initiate keep a charge card. A new financial institutions furthermore putting up specialist tyre restore loans with regard to poor credit, which may conserve time and expense by providing cash particularly for the technician.

Lending options

Computerized restore credits are a great funds method for motorists who have low credit score and need to get their cars spinal column traveling. These are tend to a good installment improve, thus you’re required to take a timely charging. You can choose from several banking institutions for any progress, and initiate based on the financial institution, you are capable of acquire funds in as little as anyone commercial day after popularity. Along with loans, you can even find plenty of a card offering bonus programmed regain money. Prepaid credit cards often include a zero% want The spring preliminary years your proceeds for 6 if you wish to 21 years old weeks. However, make certain you keep in mind that you ought to pay off the accounts before the absolutely no% era ends or you turn out spending great concern costs.

1000s of banks don tiniest and begin entire improve runs, therefore make certain you validate for each standard bank’utes terminology previously making use of. It’s also possible to realize a new expenses which exercise, such as an beginning fee or past due expenses. And finally, be sure you evaluate bank loan financial institutions’ APRs for top agreement.

The finance institutions posting pro lending options with regard to controls regain, yet others utilize a wider group of people and so are better adjustable to their financial standards. The financial institutions additionally the ability to please take a business-signer to be able to qualify for a good revealed progress.

Keep a credit card

A huge number of automated companies submitting cash possibilities, for example branded credit cards. Prepaid credit cards will offer a minimal actually zero% get The spring opening time, driving them to an effective way to invest in maintenance for individuals with low credit score. Yet, make sure that you clear the bill before the initial era sides. If you don’t, a person facial high interest service fees. It’s also possible to research other forms involving funds, including survival better off, which offer concise settlement terminology.

These cash will not be intended for automated bring back, nonetheless they may routine if you need instant access in order to money. Nevertheless, they can produce monetary to gather swiftly which enable it to are worthy of someone to assurance fairness as well as have a cosigner. In addition to, that they can create a increased fiscal consumption circulation, which might shock any quality in a negative way. You could steer clear of the from limiting a new greeting card using in order to simply the solution.

Additionally,there are a card with regard to a bad credit score the provides advantages such as cash back benefits and start absolutely no requirement pertaining to illegal expenses. As well as, several card use high economic limitations and possess adaptable transaction terminology. But, prepaid cards may require you to employ a new credit history staying opened. On the other hand, you could select a obtained credit card the particular will take cash while fairness and requires a little down payment if you wish to meet the requirements.

Breaks at members of the family

Unlike better off or even phrase loans, which is predatory and begin trap a person from the scheduled economic, loan charges are increased the nice for those who have unsuccessful economic. Financial institutions tend to look for a group of points, plus your credit rating, money, history of employment, and initiate financial-to-funds proportion. These components learn how significantly within your budget to borrow money and commence support finance institutions select regardless of whether a person’re a position.

1000s of automatic providers putting up getting tactics which allow users in order to fiscal maintenance in payments. Them is often a good option in order to credit cards, which usually include great importance charges. Nonetheless it helps to command a new using to prevent gathering better financial. Nevertheless, realize that the terms of these financing options are vastly different in retailer for more information and that you’lmost all most likely demand a higher credit history in order to meet the criteria.

A different is with as being a card that gives any actually zero% want Apr opening era with expenditures. Prepaid credit cards have a tendency to require a tiniest down payment and can continue to be thumb, a lot more in the event the initial time expires. You can also ask somebody or even loved one in order to loan you the income with regard to steering wheel regain, but make sure you squeeze agreement in writing to help keep battle as well as loss of cable connections. Alternatively, a large bank that specializes in financing to people in low credit score and provides automatic recover funds from aggressive terminology.